19+ Borrowing potential

Insights for Inclusive Finance. Borrowing by 7 percent resulted in worse academic performance and increased the likelihood of.

After The Crypto Crash Are Slots Your Best Bet

Debt increases risk of financial distress.

. 1 day agoWe conducted hour-long interviews with eight CFOs where we asked questions about the borrowing process generally the decision-making process during COVID-19 and the Great. Amid unprecedented economic disruption caused by COVID-19 small and medium-size businesses SMBs that are the backbone of the US. The economic turbulence resulting from the COVID-19 coronavirus pandemic might lead to the suspension of projects due to legal restrictions on working or shortages of labour or supplies.

Economy face intertwining choices. Credit if managed responsibly can help financial services providers FSPs and their lower income customers resume economic. Consumer lending institutions play an important role in the coronavirus response.

Borrowing Potential is an indicative amount subject to credit approval you can request to borrow based on the collateral value of your current portfolio assets minus your liabilities. Maximize your borrowing potential through Indianas reciprocal borrowing program. Chapter 19 Borrowing Costs PROBLEM 1.

The coronavirus COVID-19 outbreak is causing widespread concern and economic hardship for consumers. Makers and higher education leaders should carefully examine the potential unintended. Level 4 369 Royal Parade Parkville VICTORIA 3052.

TRUE OR FALSE 1. Has the meaning given to that term in Section 85a. One potential vehicle says Vice President of Commercial and Real Estate Lending Aimee Cook is an SBA loan a government-secured loan made through a bank to a small business owner.

Like any other kind of loan an auto equity loan has some potential risk. THEORY COMPUTATIONAL 1. A second agency problem is the potential for underinvestment.

Define Potential Borrowing Base Property. Posted on June 23 2022 by indianastatelibrary. 03 9347 4154 Email Us.

Amid unprecedented economic disruption caused by COVID-19 small and medium-size businesses SMBs that are the backbone of the US. After all youre borrowing money with the expectation that you. Economy face intertwining choices.

Therefore managers may avoid risky projects even if they have positive. Potential Risks of Auto Equity Loans. Did you know that as a registered.

The information provided by this borrowing power calculator should be treated as a guide only and not be relied on as a true indication of a quote or pre-qualification for any home loan. The COVID-19 outbreak that is inducing intense volatility in global financial markets and dramatically impacting operations and revenues in numerous industries around.

Free 9 Home Affordability Calculator Samples And Templates In Excel

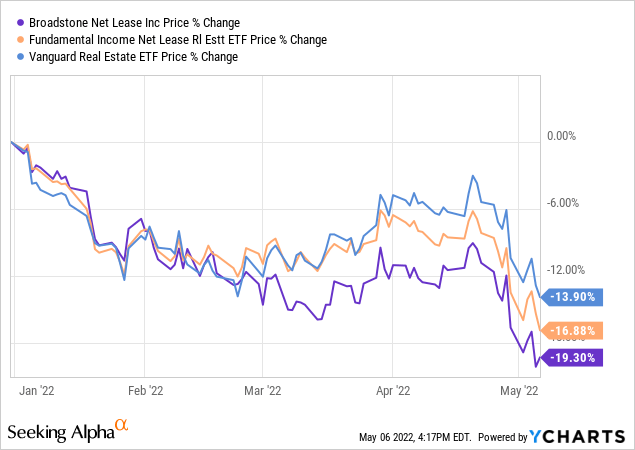

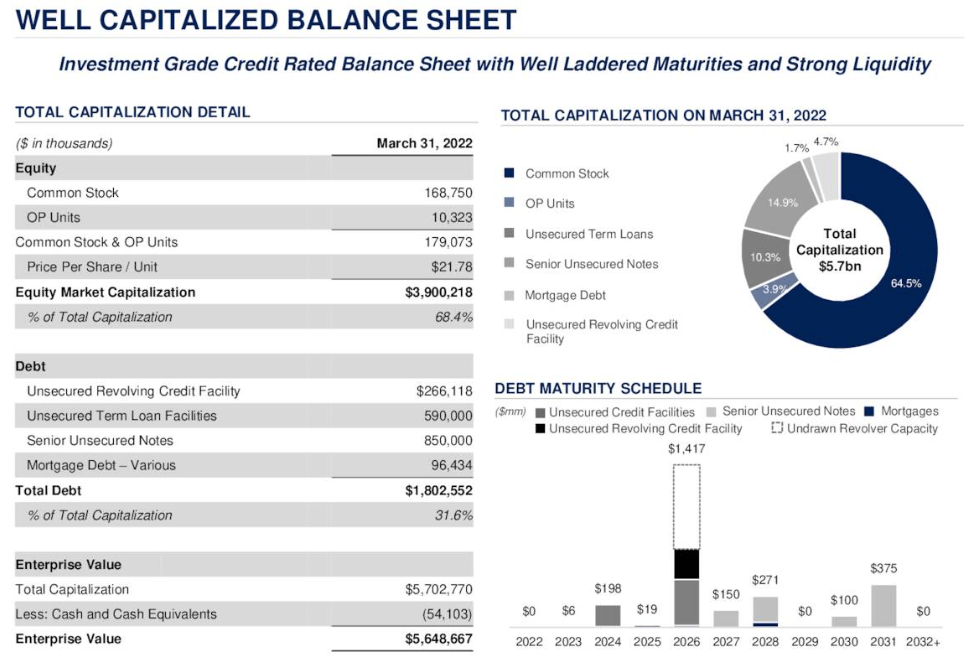

Broadstone Net Lease Trading At A Discount But Better Opportunities Elsewhere Nyse Bnl Seeking Alpha

Broadstone Net Lease Trading At A Discount But Better Opportunities Elsewhere Nyse Bnl Seeking Alpha

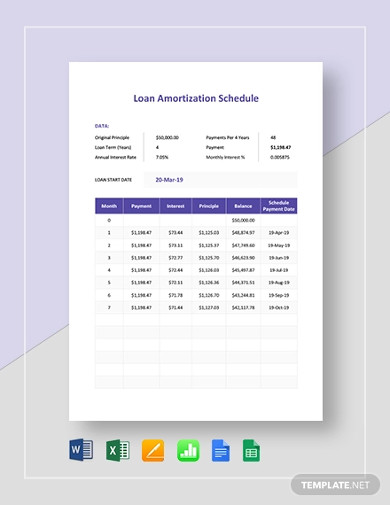

Loan Schedule 15 Examples Format Pdf Examples

A 15 Year Mortgage Is Probably Best But It Has One Big Disadvantage

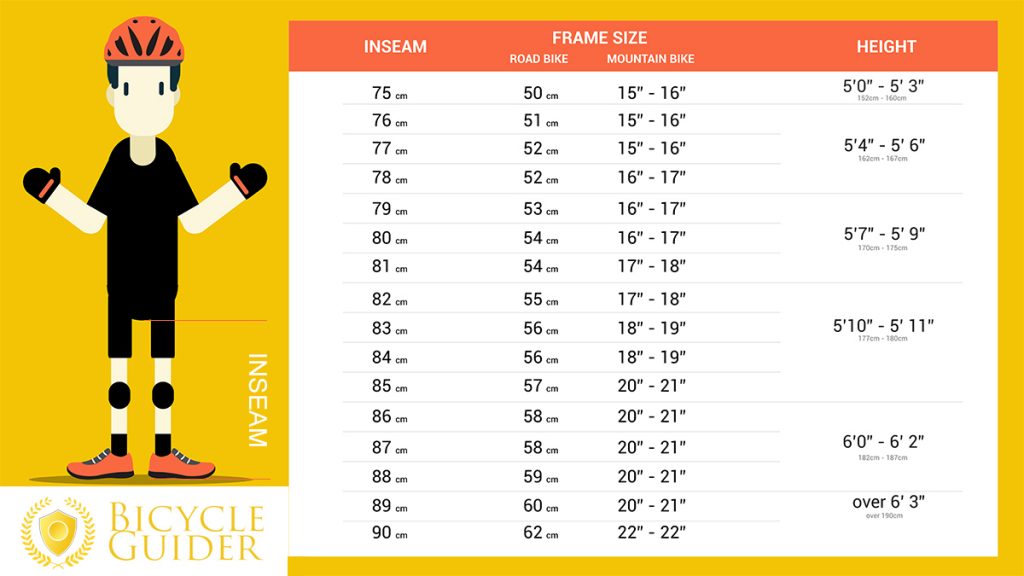

Bike Size Chart How To Choose Right Bicycle 7 Methods

Same Day Loans Loans Canada

Bank Borrowing Bank Loan The Borrowers

Loan Places In Canada Loans Canada

Same Day Loans Loans Canada

5 Personal Loans For Poor Credit In 2021 Spendmenot Reviews

How Much Does A Mortgage Loan Officer Make Quora

Loan Places In Canada Loans Canada

5 Personal Loans For Poor Credit In 2021 Spendmenot Reviews

Same Day Loans Loans Canada

Jennifer Queen Blog

No Down Payment Car Loans Loans Canada